Equipment Loans

Flexible: choose a long-term loan or a short-term lease

Easy: You don’t need a high credit score to qualify

Credit: Loans are asset-based, not credit-based

Cost-saving: Leases can cover maintenance and repairs

Equipment Loans

Lending Overview

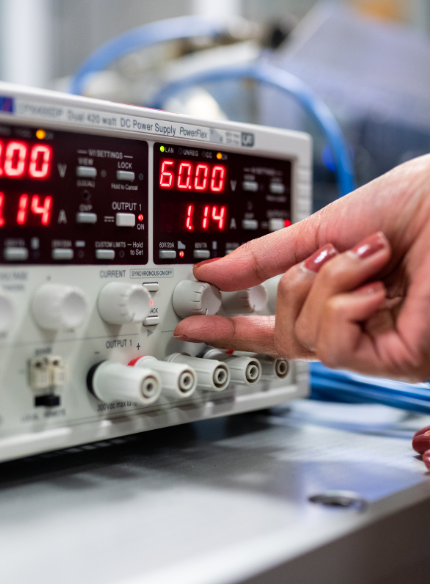

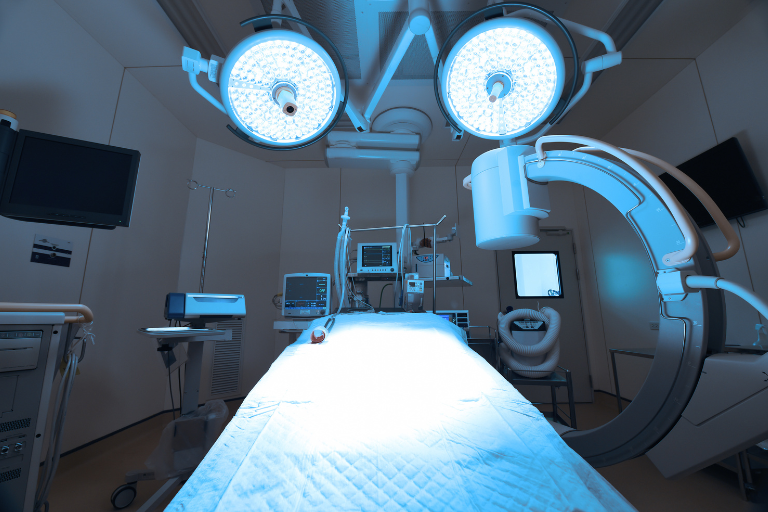

The longer you wait to upgrade or replace your equipment, the less time you can spend earning revenue. But new tech and equipment can be expensive if you have to pay for it upfront. With an equipment loan, you can break down immediate costs into smaller payments over time. That means you can get the equipment you need without having to wait. Equipment loans put new technology within reach for small businesses, helping them be more competitive, safer, and more advanced. Equipment loans can be credit-based or asset-based and come from a variety of lenders. You can qualify for one even if your credit has taken a hit, through a hard money lender or the SBA. Equipment loans cover medical, industrial, restaurant, retail, technical, and construction machines and devices. With the rapid advance of AI-enabled devices and IoT connectivity, it’s more important now than ever to keep your equipment up-to-date. Ask your broker how.

The Funding Lane

How to Effectively Apply Funds

When it comes to equipment financing, you have several options. Loans let you borrow a lump sum to cover the cost of new equipment. Leases allow you to get short-term equipment and offload maintenance and repair costs. A sale-leaseback gives you access to the equity in your existing equipment without having to remove it from your workflow. You can also use a hard money loan to buy or leverage equipment. If your equipment is built to last 10 years or longer, a loan is likely your best bet. Leases work when your equipment’s expected useful life is closer to five years. To find out which option is the best for you, consult a broker.

Finance

Equipment loans help you buy long-term equipment without paying high costs upfront. You can onboard new tech now without having to sacrifice capital you could place in high-yield investments. To find out how an equipment loan can reduce opportunity costs, speak with a broker about personalized options today.

Lease

Most equipment loans have 3-7 year terms, but that doesn’t mean your equipment will last that long. Don’t get stuck paying on a loan for equipment you no longer use. Lease instead. A lease gives you access to short-term equipment, upgrades, maintenance, and repairs with a quarterly or monthly payment plan.

Sale-Leaseback

When you have equipment but need capital, you can leverage the equity in your equipment without having to give it up. A sale-leaseback gives you a lump sum based on the equipment’s value. Then, lease it back from the new owner under a leasing contract. You can keep your equipment in place and working for you.

Learn More

FAQ’s

We believe that the more you know, the better the decisions you make. And in the financing world, better decisions mean lower rates, better terms, and increased profitability.

These FAQs are only the start. Our team is here to answer all of your questions and support you in finding the best financing solution for your unique scenario.

Q. Can a startup get equipment financing?

Yes, startups can qualify for equipment financing. Since most equipment loans use the equipment itself as collateral, lenders are secured against risk. That means they’re more willing to extend funding to startups.

Q. What type of loan is an equipment loan?

An equipment loan is an asset-based loan that uses the value of the equipment to determine the loan amount. This makes it easier for companies with low credit scores to secure financing. You can also get a loan through the SBA that covers equipment for a low 10% minimum down payment.

Q. How do I qualify for an equipment loan?

Equipment loans are available from a variety of lenders, each with their own requirements. However, working with a broker can improve your chances of getting approved. That’s because they know what lenders want to see and can match you to the right lender for your specific needs.

Q. Can I use an equipment loan to buy software?

Yes, equipment loans aren’t just for machines and robotics. Depending on the type of software you need, you can find a loan that covers it. Equipment loans also cover computers, networks, and communications. Ask a broker if your software is eligible.

Get Funded

The funding process starts with a short 3 minute online application. Our team will then review your needs and quickly provide you with a custom funding proposal that targets your desired financing types, rates, and terms.